B2B GEICO: 7 Powerful Strategies for Business Success

When it comes to B2B partnerships in the insurance sector, B2B GEICO stands out as a game-changer. With innovative solutions and trusted reliability, businesses are unlocking new levels of efficiency and protection.

B2B GEICO: Understanding the Core Concept

The term B2B GEICO refers to the business-to-business services and partnerships offered by GEICO, one of the largest auto insurers in the United States. While GEICO is widely known for its direct-to-consumer model, its B2B offerings are increasingly shaping how companies manage fleet insurance, employee benefits, and corporate risk mitigation.

What Does B2B Mean in the Context of GEICO?

B2B, or business-to-business, in GEICO’s ecosystem, involves providing insurance solutions not to individual customers, but to other businesses. This includes commercial auto insurance, group policies for employees, and strategic partnerships with brokers and agencies.

- GEICO serves over 25 million policyholders, many of whom are businesses with fleets or employee groups.

- The company partners with third-party administrators (TPAs), brokers, and fleet management companies to extend its reach.

- These partnerships allow GEICO to offer tailored solutions without direct sales to end-business clients.

How GEICO’s B2B Model Differs from B2C

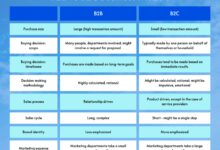

Unlike its famous TV ads targeting individual drivers, GEICO’s B2B approach is more nuanced and relationship-driven. It focuses on scalability, risk pooling, and long-term contracts.

- B2C is transactional and price-sensitive; B2B is consultative and service-oriented.

- B2B clients often require customized coverage, claims management integration, and reporting tools.

- GEICO leverages data analytics to provide businesses with usage-based insurance models and fleet safety programs.

“GEICO’s strength in B2B lies in its ability to scale proven personal lines expertise into commercial solutions.” — Insurance Journal, www.ijournal.com

Key B2B GEICO Services for Businesses

GEICO doesn’t just insure cars—it insures business operations. From small fleets to large corporate accounts, the company offers a range of services designed to reduce risk and lower costs.

Commercial Auto Insurance

This is one of the most prominent B2B GEICO offerings. Businesses that operate vehicles—delivery services, contractors, transportation firms—can benefit from comprehensive coverage.

- Covers liability, collision, comprehensive, medical payments, and uninsured motorist protection.

- Available for light, medium, and heavy-duty vehicles.

- GEICO’s fleet program offers discounts for businesses with five or more vehicles.

For more details, visit GEICO’s official commercial insurance page: www.geico.com/commercial.

Workers’ Compensation and Liability Insurance

While GEICO is best known for auto, it also partners with carriers to offer workers’ comp and general liability through affiliated programs.

- These are often administered through third-party partners like Gallagher or Lockton.

- GEICO provides underwriting support and claims processing infrastructure.

- Businesses gain access to bundled policies that streamline coverage and reduce administrative overhead.

Employee Benefits and Group Auto Programs

GEICO offers group auto insurance programs for employees of large organizations, including corporations, universities, and government agencies.

- Employees receive discounted rates through payroll deduction or direct billing.

- Employers benefit from improved employee satisfaction and reduced personal vehicle risk.

- Programs are customizable based on company size, location, and risk profile.

How B2B GEICO Partnerships Work

GEICO’s B2B success is built on strategic alliances. Rather than building a massive direct sales force for commercial lines, the company leverages partnerships to scale efficiently.

Partnership with Insurance Brokers and Agencies

GEICO collaborates with independent agents and brokers who serve business clients. These intermediaries offer GEICO’s commercial products as part of a broader portfolio.

- Brokers gain access to GEICO’s competitive pricing and brand recognition.

- GEICO benefits from the broker’s client relationships and industry expertise.

- This model reduces customer acquisition costs and increases market penetration.

Fleet Management Companies and TPAs

Third-party administrators (TPAs) and fleet management firms integrate GEICO’s insurance solutions into their service offerings.

- TPAs handle claims, risk assessment, and policy administration on behalf of clients.

- GEICO provides backend support, underwriting, and claims adjudication.

- This allows businesses to focus on operations while GEICO and the TPA manage risk.

“The future of B2B insurance is embedded partnerships—GEICO is already leading this shift.” — Forbes Insurance Insights, www.forbes.com/insurance

Benefits of Choosing B2B GEICO for Your Business

Why should a business consider GEICO for its insurance needs? The answer lies in cost savings, reliability, and innovation.

Cost Efficiency and Competitive Pricing

GEICO’s operational efficiency translates into lower premiums for businesses.

- Low overhead due to minimal advertising in B2B channels.

- Volume discounts for fleet and group policies.

- Transparent pricing with no hidden fees.

Strong Claims Support and Customer Service

GEICO’s claims process is known for speed and fairness—critical for businesses that can’t afford downtime.

- 24/7 claims reporting via phone, app, or online portal.

- Dedicated claims representatives for commercial accounts.

- Mobile adjusters and quick settlement options.

Technology Integration and Data Analytics

GEICO offers digital tools that help businesses monitor risk and improve safety.

- Fleet tracking integration with telematics devices.

- Usage-based insurance (UBI) programs that reward safe driving.

- Custom dashboards for policy management and claims history.

B2B GEICO and Digital Transformation

In the age of digital disruption, GEICO is not just keeping up—it’s leading the charge in B2B insurance innovation.

Online Platforms for Business Clients

GEICO has developed secure online portals where businesses can manage policies, file claims, and access reports.

- Self-service tools reduce dependency on agents for routine tasks.

- Real-time policy updates and digital document storage.

- Integration with accounting and HR software for seamless administration.

Mobile Apps and Telematics

The GEICO mobile app now supports commercial users with features tailored to fleet managers.

- Drivers can report accidents, upload photos, and track claim status.

- Telematics data helps identify risky behaviors and improve training.

- APIs allow integration with fleet management systems like Fleetio or Samsara.

AI and Predictive Analytics in Risk Management

GEICO uses artificial intelligence to assess risk and prevent losses before they occur.

- Predictive models analyze driving patterns to forecast accident likelihood.

- AI-powered chatbots assist with policy inquiries and claims guidance.

- Machine learning improves underwriting accuracy and fraud detection.

Challenges and Limitations of B2B GEICO

Despite its strengths, GEICO’s B2B model is not without challenges. Understanding these limitations helps businesses make informed decisions.

Limited Direct B2B Sales Force

Unlike competitors such as State Farm or Liberty Mutual, GEICO does not have a large network of commercial agents.

- Businesses may need to go through a broker, which can add complexity.

- Smaller companies might find it harder to get personalized attention.

- Direct support is often limited to larger fleet accounts.

Narrower Product Range Compared to Full-Service Carriers

GEICO focuses primarily on auto and related coverages, lacking the breadth of a full commercial insurer.

- No standalone cyber liability, professional liability, or property insurance.

- Businesses with complex needs may need to supplement with other carriers.

- GEICO often partners with other insurers to fill these gaps.

“GEICO excels in auto, but businesses with diverse risks need a multi-carrier strategy.” — Risk & Insurance Magazine, www.riskandinsurance.com

Future Trends in B2B GEICO and Commercial Insurance

The future of B2B GEICO is shaped by technology, regulation, and evolving business needs. Here’s what to expect in the coming years.

Expansion into Niche Markets

GEICO is exploring specialized verticals like rideshare fleets, last-mile delivery, and electric vehicle (EV) commercial use.

- Policies tailored for gig economy drivers using platforms like Uber or DoorDash.

- EV-specific coverage addressing battery risks and charging infrastructure.

- Partnerships with EV manufacturers and charging networks.

Increased Use of IoT and Real-Time Monitoring

Internet of Things (IoT) devices will play a bigger role in GEICO’s B2B offerings.

- Sensors in vehicles monitor speed, braking, and engine health.

- Real-time alerts help prevent accidents and reduce maintenance costs.

- Data feeds into dynamic pricing models for usage-based insurance.

Sustainability and Green Insurance Initiatives

As businesses prioritize ESG (Environmental, Social, Governance), GEICO is adapting its B2B model.

- Discounts for companies using hybrid or electric fleets.

- Carbon footprint tracking integrated into policy dashboards.

- Support for green driving training programs.

What is B2B GEICO?

B2B GEICO refers to the business-to-business insurance services and partnerships offered by GEICO, including commercial auto insurance, fleet coverage, and employee group programs. It allows companies to leverage GEICO’s brand, pricing, and claims support through brokers, TPAs, or direct programs.

Does GEICO offer workers’ compensation insurance?

GEICO does not directly sell workers’ compensation insurance but partners with third-party administrators and carriers to offer it as part of a bundled commercial package. Businesses can access these through affiliated agencies.

How can my business get a GEICO fleet discount?

Businesses with five or more vehicles qualify for GEICO’s fleet program. You can apply through a GEICO agent or broker, or visit www.geico.com/commercial to get a quote.

Is GEICO good for small business insurance?

Yes, GEICO is a strong option for small businesses, especially those with vehicles. Its competitive pricing, digital tools, and reliable claims service make it a top choice, though businesses with non-auto needs may require additional coverage from other insurers.

Can I integrate GEICO with my fleet management software?

Yes, GEICO offers API integrations with popular fleet management platforms like Samsara, Fleetio, and KeepTruckin, enabling seamless data exchange for policy management, claims, and driver behavior monitoring.

In conclusion, B2B GEICO represents a powerful blend of brand trust, operational efficiency, and strategic partnerships. While it may not offer every commercial insurance product, its focus on auto, fleet, and employee programs makes it a compelling choice for businesses looking to reduce risk and costs. As technology evolves, GEICO’s role in the B2B space is set to expand, offering smarter, more integrated solutions for modern enterprises. Whether you’re a small contractor or a large logistics firm, understanding how B2B GEICO works can unlock significant value for your organization.

b2b geico – B2b geico menjadi aspek penting yang dibahas di sini.

Further Reading: